IRS Hits Prince Estate With $38 Million Bill, Disputes Valuation

The Internal Revenue Service has filed paperwork in U.S. Tax Court claiming that the administrator's of Prince's estate devalued the late star's assets by more than $80 million.

As reported by the StarTribune, Comerica Bank & Trust, the estate's executor, valued it at $82.3 million, but the IRS arrived at $163.2 million, nearly double that figure. This increases the estate's tax bill by $32.4 million. Then the government added an extra $6.4 million as an "accuracy-related penalty" due to the "substantial" difference.

Some of the biggest points of contention between the two organizations are the value of Prince's real estate and music holdings. Comerica estimated NPG Records at $19.5 million and NPG Music Publishing at $21 million, while the IRS believes they're worth $46.5 million and $36.9 million, respectively. Plus, the government says the 185 acres of land in Chanhassen, Minn., where Prince lived prior to Paisley Park, that is currently being transformed into a housing development, is worth $21.4 million, with Comerica claiming its value is only $15.7 million.

The IRS also took issue with a $36,000 cash payment Prince made in 2014 to ex-Revolution guitarist Wendy Melvoin to go to his former fiancee Susannah Melvoin, saying that it should be considered a taxable gift since there was "a promise to repay."

Sharon Nelson, Prince's sister and one of the heirs currently involved in the already-messy and lengthy legal probate process involved with his estate, filed her own paperwork that revealed that she's been in touch with the IRS on the matter, and that Comerica has yet to "fully inform [the heirs] on business matters including the tax proceedings."

Comerica, who filed suit against the IRS this summer, has asked for a trial to be held in St. Paul.

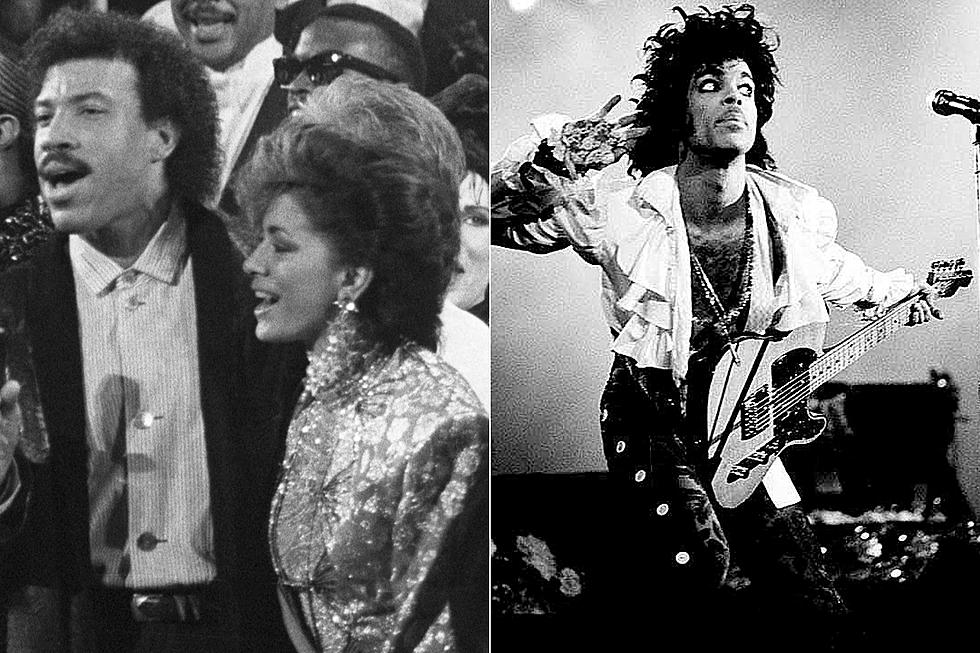

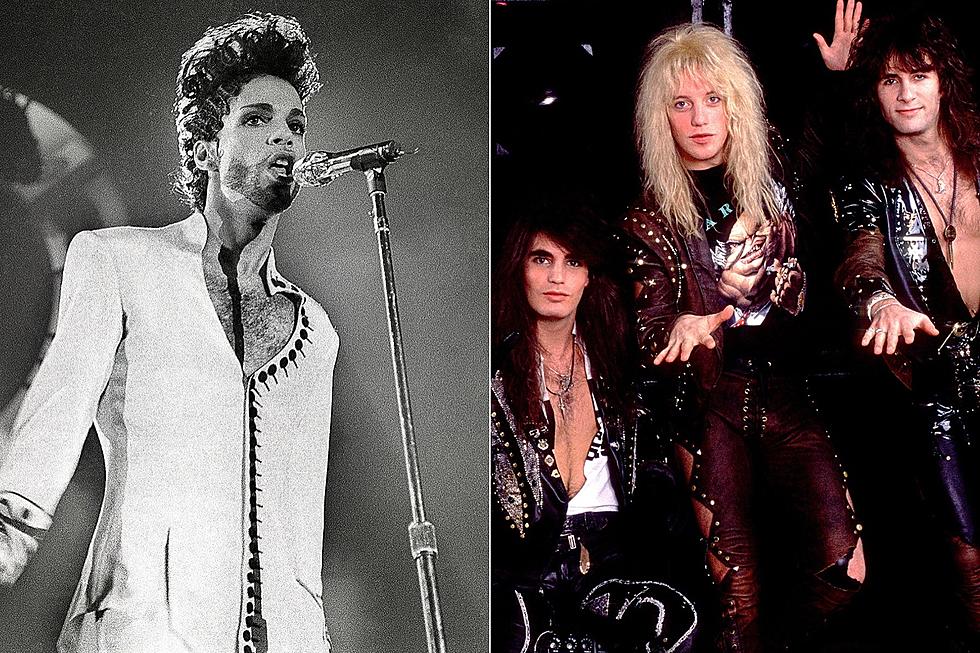

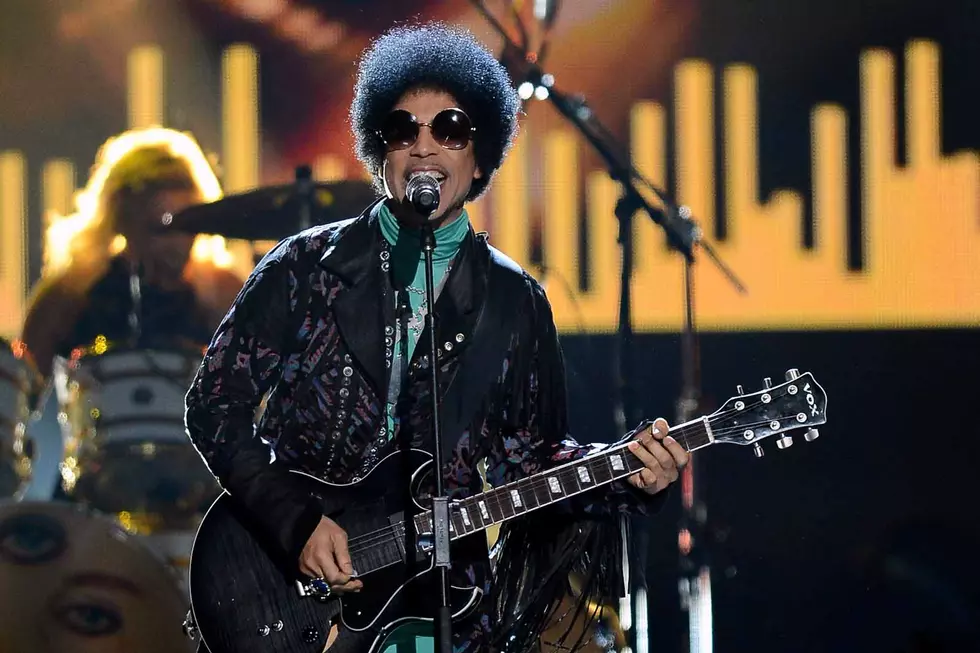

Prince Year by Year in Photographs

More From Ultimate Prince